A note on this page's publication date

The last time we examined Chamroeun was in 2010. In our latest open-ended review of charities, we determined that it was unlikely to meet our criteria based on our past examination of it, so we did not revisit it.

We invite all charities that feel they meet our criteria to complete a charity submission form.

The content we created in 2010 appears below. This content is likely to be no longer fully accurate, both with respect to what it says about Chamroeun and with respect to what it implies about our own views and positions. With that said, we do feel that the takeaways from this examination are sufficient not to prioritize re-opening our investigation of this organization at this time.

Published: 2010

Note: We are not planning to update our review of Chamroeun this year because our understanding is that its need for more funding is fairly limited (less than $50,000).

Summary

Chamroeun is a microfinance institution in Cambodia. Chamroeun offers microloans. It is not licensed to offer saving services other than required savings for its loan clients.1

Approximately 80% of its clients are women.2

When we reviewed Chamroeun, we sought to answer our questions for evaluating microfinance organizations.

Chamroeun shows a strong focus on collecting the information necessary to assess its social impact, including (a) data on how many clients are dropping out of the program (and why); (b) data on clients' satisfaction with the program; (c) data on whether Chamroeun is succeeding in its attempt to target people with very low incomes.

We believe that Chamroeun stands above every other microfinance institution we have reviewed, with the exception of the Small Enterprise Foundation, for its strong commitment to self-evaluation. Nevertheless, we have concerns about the overall impact of microlending on poverty. (For more on this general issue, see our blog post, "Is borrowing good for the borrowers?")

Table of Contents

- A note on this page's publication date

- Summary

- Key questions about social impact

- Room for more funds

- Remaining questions

- Financials

- Sources

Key questions about social impact

In evaluating Chamroeun, we asked our key questions for evaluating microlending charities. The sections below cover what answers to our key questions are available from publicly-available sources and from information provided by Grégoire Héaulme, chairman of the board of directors of Chamroeun (see the previous link for why we consider these questions important).

Is Chamroeun focused on social impact?

How frequently do borrowers drop out of the program?

Chamroeun calculates its client retention rate as the percent of closed loans that are subsequently renewed.3 Chamroeun calculates this rate monthly.4 This rate averaged 75% between August 2006 and April 2010 and ranged from 61% to 82%.5 Chamroeun's target is 80% for 2010. Note that because Chamroeun's retention rate is measured in terms of loans (of which a client may have more than one per year) it may overstate retention when compared to organizations that measure drop out in terms of people.

Does Chamroeun monitor why borrowers drop out?

Chamroeun surveyed 117 drop outs in 2008.6 These drop outs gave the following reasons for leaving Chamroeun:7

- Were asked to leave due to late repayments (12% of drop outs)

- Were unable to find a "co-maker," a non-relative who agrees to pay back the loan if the client does not (10% of drop outs)

- Had sufficient capital for their business (20% of drop outs)

- Were too busy to travel to branches to make repayments (10% of drop outs)

- Were experiencing business problems (10% of drop outs) or external shocks such as poor rainfall, inflation, or political instability (8% of drop outs)

- Were moving out of the area (5% of drop outs)

- Were dissatisfied with loan terms (3% of drop outs)

The survey also noted that 91% of drop outs expressed a wish to borrow again from Chamroeun eventually.8

To its credit, Chamroeun readily acknowledges that the survey may suffer from some methodological issues.9

In addition, Chamroeun began conducting annual satisfaction surveys of clients in 2008. Chamroeun stands out from the vast majority of organizations we have seen in this regard; we have rarely seen regular monitoring of clients' perceptions of an organization. We believe that organizations that conduct and share the results of satisfaction surveys are better positioned to improve the quality of their services over time.

Chamroeun's surveys asked clients about their satisfaction with:10

- Interest rates (91% satisfied in 2008, 93% in 2009)

- First loan amount (85% satisfied in 2008, 75% in 2009)

- Length of loan allocation process (45% unsatisfied in 2008)

- Trainings (90% satisfied with content in 2008 and 91% in 2009, 16% unsatisfied with length in 2008)

- Client relations (99% satisfied in 2008, 96% in 2009)

- Location of branches (29% satisfied in 2009)

- Way of dealing with loan delinquency (86% satisfied in 2009)

- Ease of accessing loan (91% satisfied in 2009)

These surveys are unusually honest about their own methodological flaws. Examples include:

- "A loan officer was present in each of the interviews. Despite our explanation about the neutrality of our survey, the constant presence of the loan officer has probably influenced respondents’ answers."11

- "One should be very careful while analyzing these data: partners are not sincere about this subject. Actually, none of the partners replied affirmatively to the question 'did you left Chamroeun for one of its concurrent,' although we are nearly certain that it was the case for some of them."12

Does Chamroeun prevent client over-indebtedness?

Chamroeun told us that its policy is only to issue loans to clients who are not borrowing from other sources, but that it is often difficult to determine what other credit sources clients are accessing.13

Are borrowers protected against harassment by loan officers and group members?

Chamroeun told us that it has a code of conduct for its staff and organizes monthly meetings between staff members and elected client representatives at which clients may communicate complaints.14

Loan officers are rewarded for maintaining a high repayment rate and disbursing new loans.15 It is possible that such incentives could lead to loan officers pressuring clients to repay or to take out loans they wouldn't otherwise have taken out. On the other hand, loan officers are also rewarded for maintaining a high client retention rate,16 which may lead to better treatment of clients.

What interest rates does Chamroeun charge?

Chamroeun has provided data to MFTransparency, an independent group that publishes data on microfinance interest rates.17

| Type of loan | Length of loan | % of Chamroeun loans | % of Chamroeun loan portfolio | Monthly interest rate | Annual percentage rate (APR) | Effective interest rate (EIR) |

|---|---|---|---|---|---|---|

| Chamroeun Loan | 5-7 months | 76.0% | 13.2% | 4.3% - 5.1% | 51% - 61% | 65.0% - 81.1% |

| Entrepreneurs Loan | 6-12 months | 23.5% | 86.7% | 4.0% - 4.8% | 48% - 57% | 60.3% - 74.6% |

| Developing Loan | 10 months | 0.4% | 0.0% | 4.8% | 58% | 78.0% |

| Social Emergency Loan | 4 months | 0.1% | 0.0% | 2.0% | 24% | 27% |

In addition, clients are required to name a "co-maker," a non-relative who is required to pay back the client's loan if he or she defaults.18 Clients note that they sometimes have to pay a co-maker,19 thus raising the cost of borrowing for such clients.

It appears highly unlikely that Chamroeun is offering subsidized interest rates (below the market rate for credit) since Chamroeun's rates are the highest rates of all Cambodian microfinance institutions reporting to MFTransparency.20

For more information on microfinance interest rates and how we calculate the cost of a loan to borrowers, see our microfinance glossary.

What is Chamroeun's repayment rate?

Chamroeun calculates its repayment rate by dividing all repayments received in a month by all repayments due, including both repayments due in that month and overdue payments from previous months.21 Chamroeun's average repayment rate between June 2006 and April 2010 was 97.2% and ranged from 92.5% to 100.0%.22

Excluding loans not originally due in the month gives Chamroeun's on-time collection rate. Chamroeun's on-time collection rate for November 2009 to April 2010 (the months we have data for) was 99.7%. Chamroeun's average loan term is 6 months,23 so a collection rate of 99.7% would be roughly equivalent to an annual loan loss rate of 1.2% of Chamroeun's loan portfolio.24 This is a conservative estimate as it assumes that no late payments are recovered. Chamroeun's reported loan loss rate for 2009 was 0.27%.25

Chamroeun told us that it has never rescheduled loans or written them off before they became due,26 which are practices that could artificially increase the repayment rate.27 This is largely consistent with data from Mix Market on rescheduled loans, though this data appears internally inconsistent.28

For more information on collection rates and other forms of microfinance repayment rates, see our microfinance glossary.

What are Chamroeun clients' standards of living?

Chamroeun collects data on clients through a Poverty Assessment Tool. Of those interviewed in 2009, 73% had their own toilet, 69% owned a motorbike, 65% owned a mobile phone, and 28% ate three meals per day.29

All of Chamroeun's clients receiving their first, fourth, or seventh loans, as well as a few drop out clients, were interviewed.30

For more information on standard of living surveys of microfinance clients, see our microfinance glossary.

Room for more funds

Chamroeun told us that additional donations would be used to to develop non-financial programs such as business training programs and social counseling services. In addition, Chamroeun plans to quadruple the number of clients it serves in the next four years and would use donations to help fund this expansion, as Chamroeun's parent organization, Entrepreneurs du Monde will not be able to provide sufficient funding for this.31 Chamroeun predicts that it will need about $4.6 million (19.4 billion Riels) to expand its loan fund to this size by 2014,32 including a remaining $200,000 needed in 2010 and $564,000 in 2011.33

Remaining questions

- Preventing over-indebtedness. What have investigations of clients' debt capacity found? Have these investigations prevented over-indebtedness?

Financials

All data comes from Mix Market.34

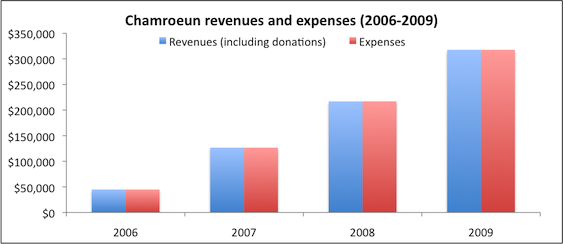

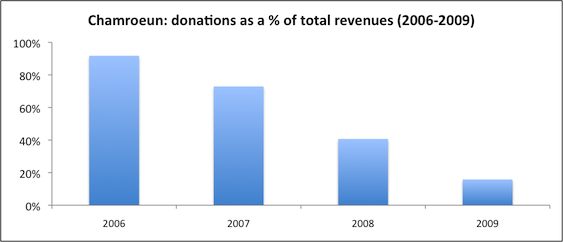

Revenue and expense growth (about this metric): Chamroeun reports receiving just enough donations in the past to cover the gap between revenues from its lending activities and its expenses. This appears to be a result of Chamroeun's accounting methods. It's 2009 audited financial statement notes, "Grant income for operating expenses is the balance which transfers from deferred grant account and it is used to balance off the expenses and incomes during the year."35

Assets-to-expenses ratio (about this metric): We normally use this metric as a partial check as to whether an organizaton is over-funded. In the case of Chamroeun (which as a bank has signifcant program revenues, we instead evaluate the role of donations in Chamroeun's revenues, checking the degree to which Chamroeun still requires donations to meet its obligations.

Expenses by program area (about this metric): Chamroeun currently runs only one program.

Expenses by IRS-reported category (about this metric): Chamroeun operates in Cambodia and is not a IRS-registered charity.

Sources

- Chamroeun. Financial statements (2009) (PDF).

- Chamroeun. Global analysis of Chamroeun partners’ satisfaction summary (2008) (DOC).

- Chamroeun. Incentive table (XLS).

- Chamroeun. Plan (2010-2014) (XLS).

- Chamroeun. Poverty assessment tool analyze (2009) (PDF).

- Chamroeun. Repayment and loyalty rate (XLS).

- Chamroeun. Satisfaction survey (2009) (DOC).

- Chamroeun. Social performance standards report (2008) (XLS).

- GiveWell. Questions for microfinance charities.

- Héaulme, Grégoire. Chamroeun Chairman of the Board of Directors. Email to GiveWell, June 2, 2010.

- Héaulme, Grégoire. Chamroeun Chairman of the Board of Directors. Email to GiveWell, June 5, 2010.

- Héaulme, Grégoire. Chamroeun Chairman of the Board of Directors. Email to GiveWell, June 24, 2010.

- Héaulme, Grégoire. Chamroeun Chairman of the Board of Directors. Phone conversation with GiveWell, June 1, 2010.

- Langeman, Tim. Calculating interest rates with excel (accessed April 27, 2010). MFTransparency blog, February 24, 2010. Archived by WebCite® at http://www.webcitation.org/5pJ4ffoh6.

- MFTransparency. Cambodia data. http://www.mftransparency.org/data/countries/kh/data/ (accessed June 23, 2010). Archived by WebCite® at http://www.webcitation.org/5qhr3fhzX.

- MFTransparency. Institution: Chamroeun. http://www.mftransparency.org/data/institutions/88/ (accessed July 9, 2010). Archived by WebCite® at http://www.webcitation.org/5r5uWaeyb.

- Mix Market. Chamroeun: Data, Indicators. http://www.mixmarket.org/mfi/chamroeun/data (accessed July 21, 2010). Archived by WebCite® at http://www.webcitation.org/5rOFbmig5.

- Mix Market. Data on Chamroeun (2006-2009) (XLS).

- Mix Market. Glossary. http://www.mixmarket.org/en/glossary (accessed May 18, 2010). Archived by WebCite® at http://www.webcitation.org/5pomL0lun.

- Rosenberg, Richard. 1999. Measuring Microcredit Deliquency: Ratios Can Be Harmful to Your Health (PDF). Occasional Paper 3. Washington DC: Consultative Group to Assist the Poorest.

- 1

Grégoire Héaulme, email to GiveWell, June 2, 2010.

- 2

Chamroeun, "Social performance standards report (2008)."

- 3

Number of loans taken out by clients who previously had a loan divided by the number of loans closed in the last 12 months. Grégoire Héaulme, phone conversation with GiveWell, July 20, 2010.

- 4

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

- 5

Chamroeun, "Repayment and Loyalty Rate."

- 6

"The interview was done on a cross section of 132 partners, of which 117 were drop out partners and 16 still in Chamroeun program. " Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 1.

- 7

"The drop out we could interview left on Chamroeun decision for 27% of them, and 70% of them left for personal reasons.

Concerning the drop out who left on the decision of Chamroeun, they are in majority linked to delays in repayments (46%) that are usually linked to health problems. Secondly, some of the partners (36%) could not make a loan because they could not find a co-maker. It is quite difficult for a partner to find a co maker: he can not be a relative, he can not borrow money, he has to pay back the partners debts in case the later did not pay back his loan, and he has to come to the branch every time the partner renew a loan.

As for the partners who left Chamroeun on personal reasons, they mainly decided or were forced to stop their business (30%). Some of them explained the reasons for this stop: the illness of the partner or of one of his relatives, a pregnancy, the project to build a new house, or the necessity for the woman to stay at home to raise the children. 28% of the partners who left Chamroeun on a personnal reasons judged they had enough capital to invest in their business. 14% did not renew their loan because they were to busy to go at the branch to pay back, or because their business is not in good shape. Some of the partners (11%) could not renew their loan because of external factors: bad raining season, inflation, elections, resources shortage. 7% of them did not renew a loan because they were moving from Phnom Penh, and 5% because they were not happy with the amount of the loan for first cycle and with the necessity to pay back weekly for the first cycle." Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 3. - 8

"92% of the interviewed drop out want to renew a loan in a MFI, while 91% want to borrow again in Chamroeun. These figures can predict that many custommers will turn back to Chamroeun." Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 3.

- 9

"Before we start analyzing the reasons for the drop out departure, one should specify that the departure for another MFI has never been recalled by a partner, probably because the drop outs wants Chamroeun to have a good appreciation on them in case they would like to borrow again in the future. Moreover, some of the partners could not be interviewed for three main reasons: the drop out moved from Phnom Penh, he now works in a company and can not be interviewed, or he is angry at the staff." Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 3.

- 10

Chamroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)."

Chamroeun, "Satisfaction Survey (2009)." - 11

Chamroeun, "Satisfaction Survey (2009)," Pg 6.

- 12

Chamroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 2.

- 13

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

Grégoire Héaulme, phone conversation with GiveWell, July 20, 2010. - 14

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

- 15

Chamroeun, "Incentive Table."

- 16

Chamroeun, "Incentive Table."

- 17

Data from MFTransparency, "Institution: Chamroeun." Annual percentage rate (APR) and effective interest rate (EIR) were calculated by MFTransparency. Monthly rates were calculated by GiveWell by dividing annual percentage rates by 12. Note that the APR is equal to 12 times the monthly interest rate, while the EIR fully incorporates "compounding," whose relevance to microloans is debatable.

For more information on calculating interest rates for microfinance banks, Langeman 2010.

We were concerned that rates calculated by MFTransparency might not include costs to borrowers such as "sales of pass books, loan processing fees and fees from training courses and others." (Chamroeun, "Financial Statements,' Pg 31.) Chamroeun told us that loan processing fees are included in the calculation, that one pass book is provided for free to clients but that they are required to purchase replacement books if they lose them, and that training courses are optional and attended by only a small number of clients. Grégoire Héaulme, phone conversation with GiveWell, July 20, 2010.

- 18

"It is quite difficult for a partner to find a co maker: he can not be a relative, he can not borrow money, he has to pay back the partners debts in case the later did not pay back his loan, and he has to come to the branch every time the partner renew a loan." Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 3.

- 19

"29% of the disadvantages involve a disagreement with this policy. On these 22 answers, 73% involve the necessity to pay the co maker, 18% the difficulty to find him, and 3% the impossibility for the co maker to contract a loan." Chameroeun, "Global Analysis of Chamroeun Partners’ Satisfaction Summary (2008)," Pg 4.

- 20

MFTransparency, "Cambodia Data."

- 21

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

- 22

Chamroeun, "Repayment and Loyalty Rate."

- 23

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

- 24

We used the estimation method given by Rosenberg 1999, Pg 20:

Annual loss rate (ALR) = [(1 - collection rate) / (loan term)] * 2

- 25

Mix Market, "Data on Chamroeun (2006-2009)."

- 26

Grégoire Héaulme, email to GiveWell, June 2, 2010.

- 27

See our discussion of microfinance repayment rates on our blog.

- 28

Value of renegotiated loans (gross loan portfolio) as of December 31:

- 2006: $405

- 2007: $545

- 2008: $0

- 2009: $0

Renegotiated loans (number of outstanding loans) as of December 31:

- 2006: 0

- 2007: 0

- 2008: 0

- 2009: 0

Mix Market, "Chamroeun: Data, Indicators."

We asked Grégoire Héaulme about this data inconsistency, and he reiterated that Chamroeun has never rescheduled loans and that he did not know what the data from 2006 and 2007 on the value of renegotiated loans referred to. Grégoire Héaulme, email to GiveWell, June 24, 2010. - 29

Chamroeun, "Poverty Assessment Tool Analyze (2009)," Pg 3.

- 30

"6,853 questionnaires have been administrated and encoded in WebPAT, including 5,652 questionnaires for 1st cycle loans, 1,086 questionnaires for 4th cycle loans, 105 questionnaires for 7th cycle loans. 10 other questionnaires concern partners who dropped out at cycles 2nd, 3rd, 5th, 6th, 9th and 11th." Chamroeun, "Poverty Assessment Tool Analyze (2009)," Pg 3.

"I confirm that 100% of the partners receiving a first loan, a 4th loan, a 7th loan and so on are interviewed for the Poverty Assessment Tool." Grégoire Héaulme, email to GiveWell, June 2, 2010. - 31

Grégoire Héaulme, phone conversation with GiveWell, June 1, 2010.

Grégoire Héaulme, phone conversation with GiveWell, July 20, 2010. - 32

Chamroeun, "Plan (2010-2014)."

- 33

Grégoire Héaulme, email to GiveWell, June 2, 2010.

- 34

Mix Market, "Data on Chamroeun (2006-2009)."

- 35

Chamroeun, "Audited Financial Statements (2009)," Pg 31.